Luxury brands navigate the risks and rewards of banking on celebrity ambassadors, Alibaba gears up for Singles Day with the launch of China’s largest robotics warehouse, and JD.com apologises for a sexist marketing blunder. Read China Decoded to make sense of the market

Original article was published by Business of Fashion. MGI Entertainment was interviewed by Casey Hall.

The original file can be found here

https://www.businessoffashion.com/articles/professional/chinas-celebrity-ambassador-minefield-kris-wu-fan-bingbing

An article by Casey Hall

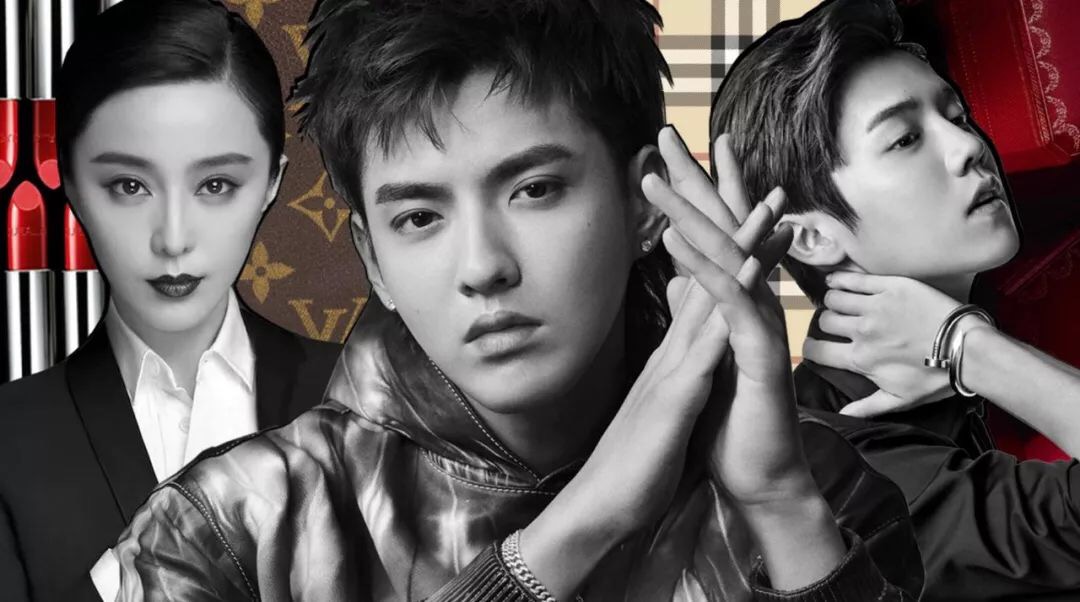

The Celebrity Ambassador Minefield

With the announcement of Kris Wu as Louis Vuitton ambassador, China’s “little fresh meat” have crested the celebrity endorsement wave. Some of the Chinese ambassador choices luxury brands are making seem out of sync with their traditional DNA, but how much does it matter?

SHANGHAI, China — Kris Wu, known in China as Wu Yifan, is a divisive figure. Much like One Direction, Justin Bieber or the succession of Western pop-star heart-throbs that came before them, Wu is derided by hip-hop aficionados for his quick journey from baby face to bad boy, questioned over the legitimacy of his talent and ribbed for the proportion of his fan base made up of excitable young women. Whether Wu cares what his critics have to say is of course another matter but, either way, they have almost no impact on his bankability or his superstar status.

It is this fact which has luxury brands, and their mass market counterparts, lining up to work with him. Last week Louis Vuitton joined Burberry, Bulgari and McDonald’s in tapping the 27-year-old K-Pop alum turned actor, hip-hop star and reality TV “producer” as the face of their brand in China, home to the world’s largest pool of luxury consumers.

TFBoys’ Wang Junkai in Dior Homme

“The trend of international brands signing up Chinese talent as ‘global spokespersons’ is not new, and in my opinion will only grow in the years to come,” posits Jonathan Schenker, chief executive at Bookmark Entertainment, an agency with offices in Shanghai, Los Angeles and London, tasked with bringing together brands and celebrities from across the East-West cultural divide.

“Chinese buying-power is unprecedented and many global brands, especially in fashion, rely on it, both domestically and overseas. It is inevitable that brands will make every effort to appeal to these customers by aligning with China not just locally, but on a global scale.”

With more than 44 million Weibo followers, there is no doubting Wu’s ability to garner attention for any brand he works with. Just 24 hours after the announcement of his new gig as Louis Vuitton’s global ambassador, the news had been shared – alongside mostly positive commentary – more than two million times on China’s top micro-blogging platform.

Fresh meat expiration dates

For Joyce Weng, Bulgari Greater China’s brand communications director, the decision to bring a ‘xiao xian rou’ (or ‘little fresh meat’, the Chinese term for fresh-faced male celebrities who appeal to a rabid female fan base between the ages of 12 and 25) celebrity on board as brand ambassador didn’t feel contrary to the DNA of the 134-year-old heritage brand.

“To me, when we started looking at Kris Wu a few years ago, he was a nice and smart and [a] pretty boy. We had different discussions and meetings to get to know him better. He gave me the feeling of seeing the future of China, that’s what I felt in him,” Weng recently said on stage at the BoF China Summit.

The long-term contribution to that brand’s DNA, that isn’t able to be measured in short-term metrics.

“He has been the one to help us to talk to Post-90s, this [generation of consumers] in China who really are the future.”

For all the hype surrounding the rise of influencer culture in China (locally known as KOLs, an acronym for Key Opinion Leaders), a recent white paper released by influencer marketing agency, Wearisma, showed the top 10 influencers with the highest reach in China are all traditional celebrities, with the highest engagement rates universally garnered by male singers.

Like Wu, male pop-stars such as Lu Han, Li Yifeng and Jackson Wang have racked up endorsement deals with luxury brands galore alongside their social media followings, some reportedly charging as much as 1 million yuan ($146,000) per social media post.

Some of these pairings have given Chinese consumers, as well as industry observers, pause as to their suitability. Earlier this year, the announcement of Lu Han as Audemar Piguet ambassador proved particularly jarring to fans of the 143-year-old Swiss watch brand, whose international ambassadors are more likely to be traditionally masculine athletes, such as LeBron James and Novak Djokovic, in contrast to the distinctly effeminate Lu Han, who like Wu is a former member of South Korean boy band, EXO.

Lu Han, Li Yifeng and Jackson Wang in campaigns for their respective ambassadorships

Although there has been a distinct shift in what is considered an appropriate spokesperson for a luxury brand all over the world, the pace and intensity of this shift seems even more dramatic in China, where the luxury market seems to evolve faster than anywhere else on earth and where luxury brands are competing for eyeballs in an increasingly crowded marketplace.

Given the pressure to achieve short-term success, it is little wonder brands bow to the pressure of attention grabbing celebrity partnerships.

Though Lyndon Morant, chief strategy officer at L’Atelier Asia Pacific, is sympathetic to the position of brands, particularly in a country such as China, where five percent of the posts on social media feature celebrities and KOLs but account for a staggering 77 percent of engagement, he warned against brands becoming slaves to the numbers.

“If all you want is comments, likes, shares, then you can buy that, but the long-term contribution to that brand’s DNA, that isn’t able to be measured in short-term metrics,” he said on stage at the BoF China Summit last month.

Walking a tightrope over a minefield

This being China, there is an added complication of working with celebrities in a communist-run country routinely rocked by officially-sanctioned crackdowns on ostentatious wealth, as well as morality campaigns. The bigger the name becomes in China, it seems, the more likely they are to attract the wrong kind of attention.

This year has, of course, seen the very public fall from grace of Fan Bingbing – China’s most famous film actress and herself a prolific endorser of brands, including Louis Vuitton, De Beers, Guerlain, and Montblanc – who disappeared from view for three months, before re-emerging last month with a public mea culpa and a massive $129 million fine for tax evasion.

“The reasons some of these celebrities have gotten in trouble in China is because they aren’t promoting wholesome Chinese values. If you look at the nature of celebrity [in China], they have to be seen as instruments of the people of China, of the government,” managing director of MGI Entertainment, Michael MacRitchie explains.

Perhaps in a nod to China’s increasingly restrictive atmosphere, Wu has recently tempered his carefully cultivated bad boy image.

If you look at the nature of celebrity in China, they have to be seen as instruments of the people of China, of the government.

Ahead of the launch of the second season of the phenomenally popular “The Rap of China” reality show this summer, he released songs and social media posts overtly praising the motherland, perhaps in order to appease officials who aren’t necessarily thrilled with the Wu-led hiphop influence that has permeated Chinese cultural life over the past two years.

“This kind of thing ebbs and flows, but for now, the big names are still going to sell [the most product],” MacRitchie says.

An unofficial alternative

The members of boy band TFBoys – Wang Junkai, Wang Yuan, and Yi Yangqianxi – may only be 18-years-old, but they already boast over 50 million followers apiece on Weibo. They are also at the forefront of a new kind of celebrity-luxury brand alliance to emerge in China over the past 12 months – the unofficial kind.

Gartner L2’s “Luxury China: Influencers” report, released in August, showed a trend for luxury brands to “draft” on the popularity of Weibo celebrities, by posting images of TFBoys members wearing their brand, without an official alliance or ambassadorship in play.

In fact, 41 percent of luxury brands tracked in the report mention at least one of the TFBoys in their Weibo posts, accounting for 28 percent of all engagement generated by posts that mention a celebrity.

TFBoys’ Wang Junkai in Dior Homme

Louis Vuitton, Dior, and Givenchy have posted images on Weibo of TFBoys wearing their product, generating what the report calls “outsized engagement”, despite the fact none of these brands are officially affiliated with the young celebs. It’s unclear what, if any, monetary inducement is on (or under) the table as part of this relationship, but the affiliation is seen as a positive for both sides.

“For brands and celebrities alike, non-ambassador partnerships can serve as a happy medium,” the report reads in part. “Luxury brands looking for a quick lift on social and celebrities at the start of their careers might both consider this method before committing to one another.”

For brands and celebrities alike, non-ambassador partnerships can serve as a happy medium.

TFBoy Wang Yuan, for example, saw an unofficial partnership with Chopard morph into a formal brand ambassadorship in May.

According to Jonathan Schenker, increasing caution will be a marker of future partnerships between Chinese celebrities and luxury brands. It’s likely in a post-Fan Bing Bing tax scandal world, the professionalism of celebrity talent managers in China will also come under scrutiny, with more targeted deals and ROI metrics the norm.

“As the number of luxury brands continues to grow and customer attention becomes harder to capture, companies are likely to use big data, tailored research and other tools to determine match-ability between a potential spokesperson and their brands,” he says.

In a relatively new luxury market, just turning up and winning the most eyeballs may have been enough, but as China matures and its consumers become increasingly discerning, credibility and relevance to a more targeted audience will be the markers of a successful celebrity partnership.

时尚与美容

FASHION & BEAUTY

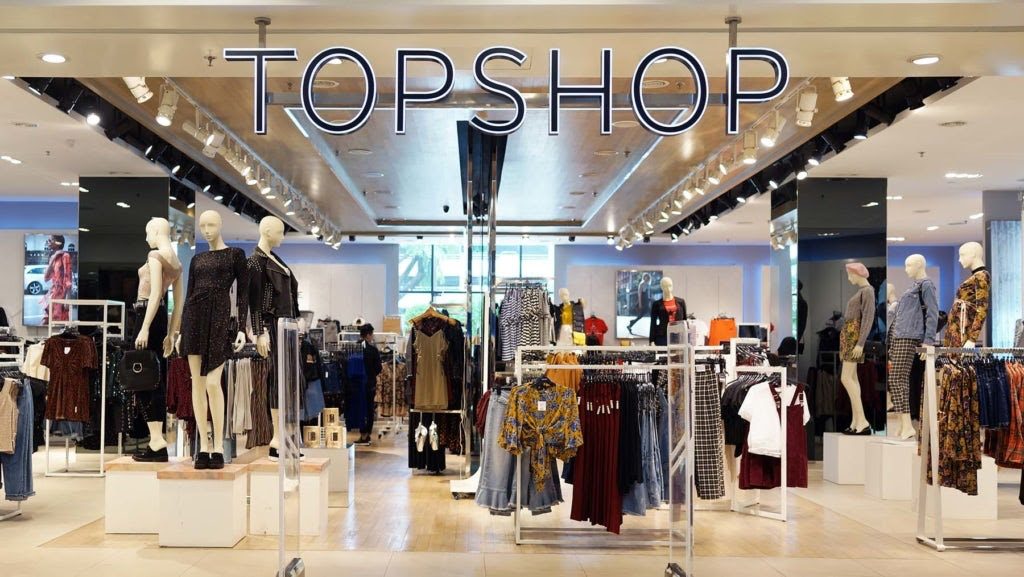

Topshop store | Source: Shutterstock

Topshop’s Tmall Closure Spurs Rumours of China Retreat

On Nov 1, Topshop’s page on Chinese e-commerce site Tmall displayed a notice announcing the closure of the British retailer’s storefront “due to global strategy adjustments,” though consumers will still be able to shop remaining Topshop and Topman stock on site until November 30. Topshop has now lost most of its gateways into the Chinese market: on August 4, the company announced the early termination of its partnership with e-tailer Shangpin, and its first mainland brick and mortar location has yet to open its doors, though it was scheduled to do so in September. Topshop hasn’t addressed the speculation of a retreat from China,, but parent company Arcadia Group’s 53 percent drop in sales alongside a bankruptcy declaration in Australia and chairman Philip Green’s alleged #MeToo sexual assault scandal are causes for concern (Jiemian)

Estée Lauder Companies, L’Oreal Report APAC Success

Estée Lauder Companies Inc., whose brands span the likes of Bobbi Brown, Tom Ford Beauty, Estée Lauder and La Mer, reported strong financial results for its first quarter ended September 30. Net sales in the Asia Pacific region rose 24 percent year-on-year at the third highest quarterly growth rate in the past two decades, and growth in Mainland China has accelerated with double digits across almost all categories. Earlier this month, Estée Lauder’s rival L’Oreal reported $7.34 billion in revenue for the third quarter, up 6.2 percent from the previous year. The group’s chief executive and chairman Jean-Paul Agon has said that despite trade tensions between Beijing and Washington, political strife hasn’t lessened the Chinese consumer’s appetite for high-end beauty products. (Luxe.co)

Chinese Beauty’s Cross Border Quagmire

Long-standing stigma against counterfeit goods is hindering China’s beauty brands, who are using “imported from” labels to rebrand themselves at home and abroad. Chinese brand Yang Sheng Tang, for example, has entered Japan’s beauty market via Isetan department stores and drugstore beauty chains, but in doing so have highlighted their “Made in Japan” products utilize raw ingredients from Finland, France and the US. With nearly 80 percent of the saturated Japanese cosmetics market dominated by local brands, marketing moves by the likes of Yang Sheng Tang, Hexze and Ray to align themselves with the Japanese, Korean and Thai beauty markets respectively may hinder them in standing out from the crowd. (36Kr)

科技与创新

TECH & INNOVATION

Collage by Jan-Nico Meyer for BoF

Douyin Sues Baidu in Internet Court

Douyin – the popular short video platform known in the US as Tik Tok – has filed a case against tech giant Baidu, claiming that the latter’s rival video app Huopai has infringed Douyin’s exclusive rights to its user generated content. In the past year, China has established three courts to deal with a growing number of internet-related disputes. The case between Baidu and Douyin – whose parent company Bytedance is now the world’s most valuable startup – will be the first heard by the Beijing-based court and will determine whether short video clips (many of which are under 15 seconds) are subject to copyright. The result will have major ramifications for China’s burgeoning livestreaming industry. (Abacus News)

Alibaba Launches China’s Biggest Robotic Warehouse Ahead of Singles Day

Last week, Alibaba posted a 54 percent quarterly revenue growth ahead of its Singles’ Day shopping festival on November 11, the tenth anniversary of the event. The tech giant has been preparing for the festival – now the world’s largest e-commerce event at four times the size of Black Friday and Cyber Monday combined – across all its platforms, and has opened China’s largest robotic warehouse to help smooth the logistical nightmare of sending out more than 812 million orders to its customers. Though sales records are likely to fall once again this Singles’ Day, questions remain as to how long this growth remains sustainable. (Technode)

The Beijing Start-up Bringing Mobile Wallets to All

The global mobile payments market is set to reach $9.35 trillion by 2026, making investors and start-ups keen to tap into this lucrative, cashless future. Mobile payments company QFPay International allows merchants to accept funds from a plethora of popular e-payment wallets, including Alipay, WeChat Pay and Union Pay. The start-up, which has sold its services to 5,700 merchants across 12 countries since January, is now focusing on expanding outside of China. The company is expected to hit $80 million in revenue by the end of 2019. (Forbes)

消费与零售

CONSUMER & RETAIL

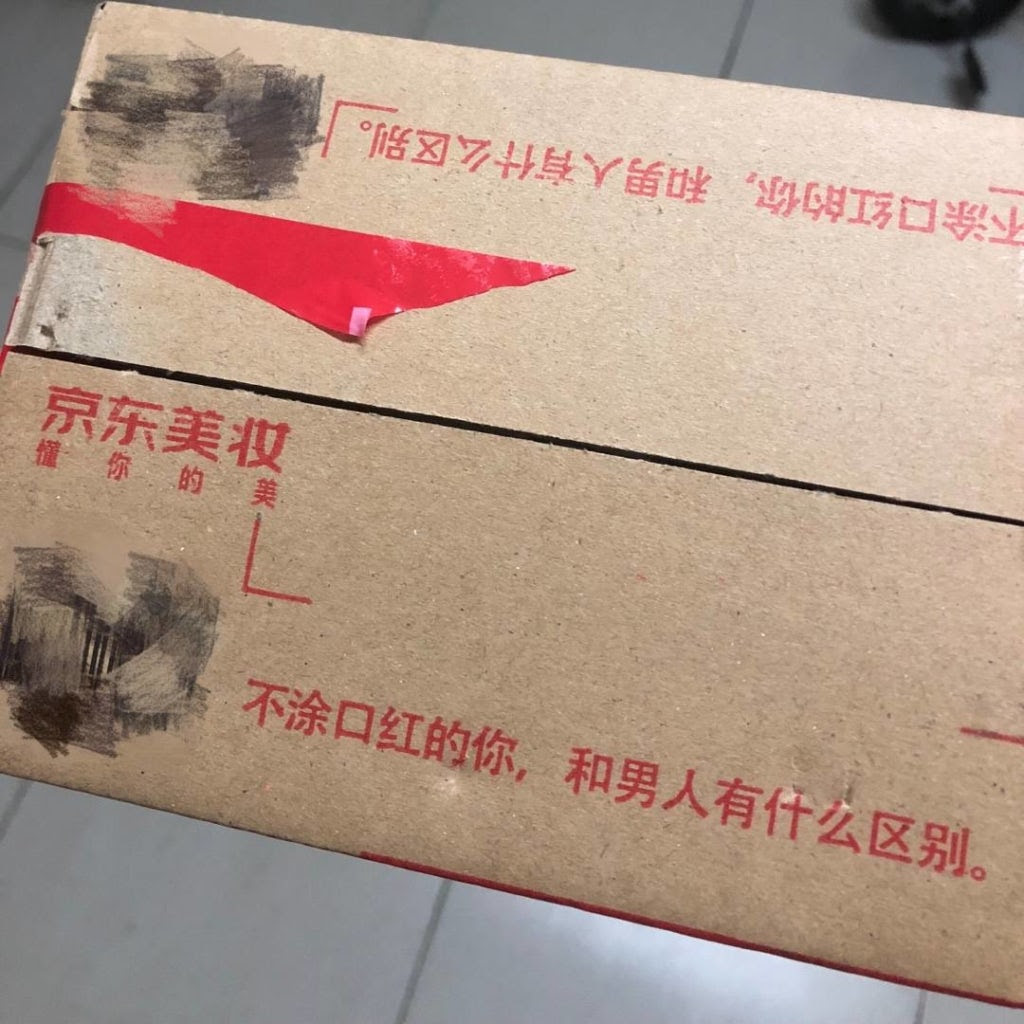

JD Beauty’s offending packaging | Source: Weibo user pinkoleander

JD.com Apologises for Sexist Marketing

Chinese e-commerce giant JD.com has apologised following an uproar on October 30, when customers of its newly launched JD Beauty platform received delivery packages emblazoned with the tagline “Without lipstick, how are you different from a man?” JD Beauty issued an apology for the “inappropriate” slogan, stating that its business was still “under development” and that the estimated 1,000 consumers would receive a free beauty product. The blunder adds to the Beijing-based company’s recent slump, which includes a reported loss of $316 million in the quarter ending June, and its founder, chairman and chief executive Richard Liu being accused of rape in Minnesota in September. (SCMP)

Alibaba and Fung Retailing Ink Lifestyle Brand Partnership

On Novermber 6, Alibaba Group Holdings and Fung Retailing – the retail business arm of Hong Kong-based conglomerate the Fung Group – announced their new` partnership to bring more international lifestyle brands to Chinese consumers. The deal will harness the latter company’s 3,000 stores worldwide, global portfolio of brands and marketing expertise with Alibaba’s technology and new retail channels to offer brands merchandising, marketing and omnichannel distribution services. It was only in February 2018 that Fung Retailing announced its partnership with Alibaba’s arch-rival JD.com to develop artificial intelligence-driven retail solutions, but Fung Retailing and Alibaba have high hopes for their new partnership, which will focus on mainland China to start but potentially expand to other regions covered by Alibaba’s platforms, which include Singapore, Indonesia, Malaysia and the Philippines. (Alibaba)

China’s Five Consumer Personas?

A new report from Euromonitor International categorises Chinese consumers into five distinct personas: The ‘Secure Traditionalist’ (an estimated 27 percent of the market) is more likely to save money and less likely to use e-commerce; the ‘Inspired Adventurer’ is an avid traveller receptive to experiential marketing and new retail experiences; the ‘Undaunted Striver’ desires branded purchases, luxury and the latest in tech; the ‘Balanced Optimist’ values wellbeing, but remains tech-savvy; and the ‘Cautious Planner’ (accounting for 13 percent of the market) is meticulous with their spending. Alas, the personas are merely an adequate starting point: demographic segmentation can only go so far, and China’s vast and non-homogenous market resists sweeping generalisations. (Jing Daily)

政治,经济与社会

POLITICS, ECONOMY & SOCIETY

Donald Trump and Xi Jinping

Xi Condemns Trump’s ‘Law of Jungle’ Trade Practices

At Shanghai’s China International Import Expo on November 5, Chinese president Xi Jinping delivered a keynote address denouncing Washington’s “America First” trade policies. Xi pledged to boost China’s domestic consumption, strengthen intellectual property protection and advance trade talks with powers in Asia and Europe. The problem will be convincing the rest of the world. In a report released by the country’s Ministry of Commerce on November 6, China’s import and export trade has improved in structure, quality and efficiency in the first three quarters of 2018 – it states that the growth rate of imports, exports is 15.2 percent and 13.6 percent respectively. Yet, the Organisation for Economic Cooperation and Development ranks China 59th out of 62 countries in its openness to foreign direct investment, and experts have long accused Beijing of being all talk on these issues. (Bloomberg)

Meet Lay Zhang, the Chart Busting Mando-Pop Star

The Mando-pop album ‘Namanana’, released by Chinese star Lay Zhang on October 30, is now the highest-ranked album from a Chinese pop artist to appear on the Billboard 200 chart. Zhang, also known by his stage name Lay or Zhang Yixing, is one of China’s most popular young idols, having found fame as a member of EXO – the popular K-pop boy band that also catapulted the career of Louis Vuitton’s new ambassador Kris Wu. Though Zhang has served as the brand ambassador for Huawei, Biotherm, and Valentino, he’s poised to attract more luxury brands eager to tap into China’s idol-driven economy. (Forbes)

Livestreaming Platform Reveals China’s Rural Opportunity

Middle-aged farmer Liu Mama is earning around $140,000 a month livestreaming her life on Kuaishou – China’s fourth largest social media platform behind WeChat, QQ and Weibo. Videos of the Dongbei native telling jokes while shucking corn and driving a tractor around her fields have attracted over 14 million followers. Although 80 percent of Kuaishou users aren’t university educated, and 70 percent earn less than $430 a month, successful accounts earn in-app ‘gifts’ purchased with real money. The platform, which takes 50 percent of users’ in-app income, is valued at $18 billion, but is overlooked compared with competitor Douyin, which has a more urban and educated user-base. In contrast with Douyin, Kuaishou remains relatively free of commercial partnerships, sponsored posts and celebrity KOLs. Kuaishou has also faced political challenges, with accounts featuring teen mothers, cross-dressers and foul-mouthed rappers being removed for conflicting with Government-mandated morality. (New Yorker)